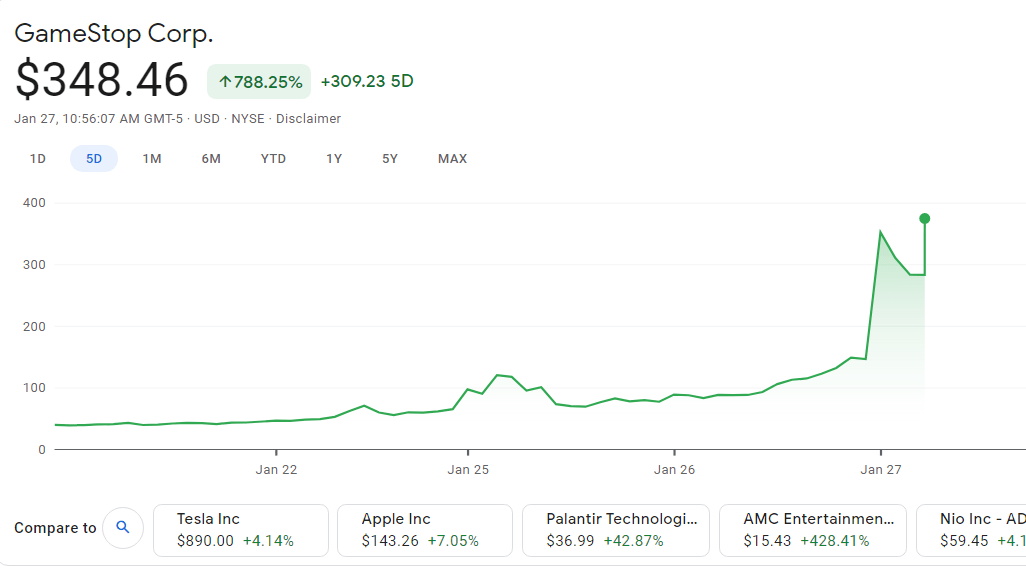

GameStop’s stock price continued to soar in after-hours trading last night to over $US300 ($390). While many are waiting for it to come crashing back down, it might be too late for some major hedge funds. With the stock still sitting at well over $US250 ($325) a share (unthinkable just last year when it was trading at under $US5 ($7)) after the market reopened, Melvin Capital, one of the largest hedge funds betting against the company, is reportedly getting out of the game after suffering major losses, seemingly driven out by amateurs trading on their phones and joking on Reddit in what continues to be one of the most bizarre stories of 2021 so far.

“Melvin Capital closed out its short position in GameStop on Tuesday afternoon after taking a huge loss,” the fund’s manager told CNBC this morning.

The firm, which was worth about $US12.5 ($16) billion before the battle between short sellers and Redditors began, bet big against GameStop and a number of other companies, only to see 30% of the fund disappear over the last few days. That prompted other billionaires to swoop in and lend Melvin $US2.75 ($4) billion to help cover the losses. Andrew Left, a notorious short-seller activist, also announced in a new YouTube video today that his investment firm moved away from most of its bets against GameStop’s stock at “a loss of 100%.”

[referenced id=”1202623″ url=”https://www.kotaku.com.au/2021/01/another-wild-day-for-gamestonk/” thumb=”https://www.gizmodo.com.au/wp-content/uploads/sites/3/2021/01/26/qam5dpnqyw3h72ibvdfg-300×169.png” title=”Another Wild Day For GameStonk” excerpt=”Last Friday, GameStop’s stock price closed at an all time high of $US65 ($85) ($US84 ($109)). Today, it shot up 18% higher, breaking records again after an even wilder day of Wall Street roulette thanks to finance redditors and enthusiast day-traders who have turned things into a meme war against elite investors.”]

Those on Reddit who helped orchestrate GameStop’s recent record-breaking ride on Wall Street aren’t buying it, however.

“Melvin capital have not closed their positions!!” a user posted in one of today’s most upvoted threads on the WallStreetBets subreddit, “The volume is too low for it to be even possible. The short interest has not changed!”

The forum has been full of comments like this as Reddit traders try to rally one another to drive GameStop’s stock price even higher, rather than cashing out now.

Meanwhile, the ensuing chaos caused GameStop stock trading to be temporarily halted yet again this morning and caused outages on the trading app Robinhood. Other companies like Blackberry and AMC are also seeing smaller, though still dramatic stock climbs, as Reddit traders attempt to go boost other companies massively shorted by big hedge funds.

All of this is the culmination of a long game that’s been brewing on the WallStreetBets subreddit for a while now as amateur day traders decided to turn the misfortunes of a floundering brick-and-mortar game seller into their cause celebre for dunking on professional investment firms. In some ways it’s a very complicated story driven by the weird mechanics of Wall Street, but in other ways it’s a familiar tale of extremely online people trying to stick it to someone, in part to make a buck, but also for the “lulz.” Here’s a quick rundown of how things got here.

- In March of 2019, Reddit user delaneydi outlined their case for why GameStop was actually worth more than the stock market was saying. (See Bloomberg’s reporting for the full timeline).

- Later that year, hedge fund operator Michael Burry, the real life character played by Christian Bale in The Big Short who managed to make mountains of cash betting on the 2007 housing collapse, gave GameStop a big vote of confidence, buying up 3% of the company when its stock was worth less than $US5 ($7) a share. This led soon-to-be WallStreetBets hero DeepFuckingValue to bring in a bunch of money and boast about it on the subreddit.

- By the following April, a Reddit user called Senior_Hedgehog was pointing out that GameStop stock was one of the most shorted on the market, and had the potential to set up a “short squeeze.” To learn more about how short selling mechanics led to the current moment, I recommend Matt Levine’s most recent Money Stuff column. Basically, a stock as shorted as GameStop’s (meaning a lot of money was bet on it failing) has the potential to create feedback loops if it rises, allowing an army of small investors trading handfuls of individual shares using an app like Robinhood to send the stock skyrocketing. Maclean’s Andray Domise also has a great summary in TikTok form.

OK I did it. Did my best to explain the GameStop hedge fund massacre in seven TikToks.

It’s heavily simplified, and I left out a few things like like puts and naked calls, but hopefully anybody who is new to all of this will get the gist of it.

Part 1: pic.twitter.com/1Qw1wIvoAl

— Brother Q. (ɔpɛ asem) (@andraydomise) January 27, 2021

- This laid the groundwork for weird stuff to happen with GameStop’s stock, but it didn’t really kick-in until earlier this month when co-founder of online pet food seller Chewy, Ryan Cohen, announced he and two of his allies would buy into GameStop and take seats on the company’s board. This gave the rest of WallStreetBets something to rally around. The subreddit nicknamed him “Papa Cohen” and started talking about riding $GME (the company’s stock exchange acronym) to the moon.

- Fast forward to January 22, and GameStop’s stock was closing at an all-time high of $US65 ($85). It went even higher after a series of booms and busts the following Monday to close at just under $US77 ($100). Yesterday, it closed at nearly double that.

- Whatever ultimately happens to GameStop’s army of Reddit backers, the fallout already has many Wall Street insiders freaking out. Even Michael Burry, GameStop’s original booster, called the stocks recent exploits “unnatural, insane, and dangerous.”

- Others are already looking to the refs — the Securities and Exchange Commission — to step in and somehow regulate the WallStreetBets meme market. No one seems to know how that would work though. “It’s an enforcement nightmare for the SEC,” James Cox, a professor at Duke University School of Law, told Bloomberg yesterday. As no shortage of people have pointed out on Twitter, some Wall Street-types only seem to be against market manipulation when they are the ones who end up getting hurt by it.

Leave a Reply