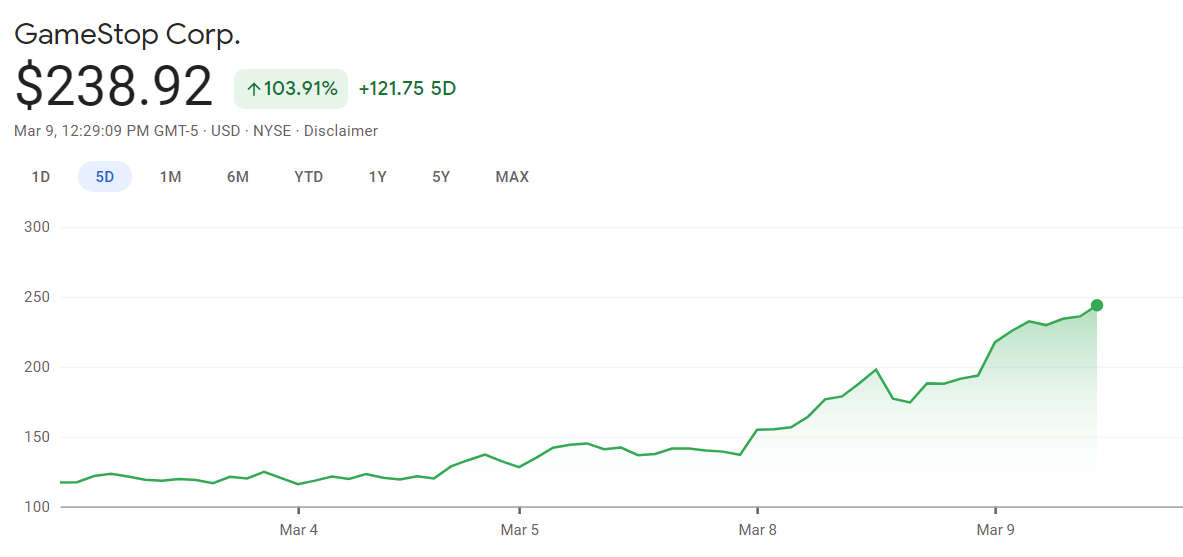

Just a few weeks ago, it seemed like the GameStop stock frenzy was finally done and dusted. But late last month, it began to rally again and was buoyed this week by the news that former pet food website founder and hero of the WallStreetBets investment subreddit, Ryan “Papa” Cohen, will be put in charge of the brick-and-mortar company’s attempt to transform into an online business.

Yesterday, GameStop announced Cohen, who founded Chewy.com, and two other members of its board of directors, including former Chewy chief marketing officer Alan Attal, would lead a new “strategic planning and capital allocation committee” in charge of coming up with ideas that “can further accelerate the company’s transformation” into an online gaming storefront. Who knows what any of that will mean in practice beyond some rich people collecting paychecks to play corporate make-believe, but it was enough to send GameStop stock over $US200 ($260) a share, up more than 900% year-to-date, according to Business Insider.

[referenced id=”1130845″ url=”https://www.kotaku.com.au/2020/09/gamestop-is-closing-another-100-stores/” thumb=”https://www.gizmodo.com.au/wp-content/uploads/sites/3/2020/09/14/nccq0ywtohmglcisos95-300×169.jpg” title=”GameStop Is Closing Another 100 Stores” excerpt=”Back in March, struggling retailer GameStop announced that it would be closing at least 320 stores over the course of the year. That number has now jumped to “between 400 and 450 stores”.”]

It was also the latest development in an investment moonshot that’s been zipping around the WallStreetBets community like prophecy: that GameStop is destined to become the Amazon of gaming and that Cohen is the fated finance bro to make that happen. Or in WallStreetBets-speak: “Papa Cohen bringing home the tendies!”

Last September, Cohen purchased a 10% stake in GameStop, making him its single biggest investor. Bloomberg reported that the venture capitalist, who sold Chewy.com to PetSmart in 2017 for $US3.35 ($4) billion, was in talks with GameStop management about his vision for how it could do the same for games and toys. One of the plan’s cornerstones reportedly includes moving GameStop’s extremely lucrative used-game business online, letting customers make trades by mail.

The irony, of course, is that Cohen’s big idea is essentially to make GameStop, the butt of endless jokes about terrible trade-in deals and pre-order upselling, everything it’s currently not. Easier said than done, especially when the share of new game sales is increasingly digital. Pets will always need to eat, but physical games are disappearing.

GameStop’s golden future also doesn’t seem to have much of a place for its current biggest asset: the people who run its stores. Suppose you’re a parent who wants to know what game to buy their kid for their birthday, or confused about the latest ridiculous console names or simply want to chat with some strangers about the latest open-world game you sunk 100 hours of your life into. Odds are you can find someone at the local GameStop to help. And they do so even as their wages are shortchanged, hours are cut, and they’re forced to operate during a once-in-a-lifetime pandemic.

None of this seems to be putting the brakes on the WallStreetBets hype train, which is once again a parade of celebratory memes, or its stock price, which spent the start of today continuing its unlikely climb. It seemed like a joke when WallStreetBets champion Keith Gill, AKA RoaringKitty, AKA DeepFuckingValue, told Congress last month during a hearing on GameStop that he would still encourage people to buy even after the meme stock bubble had seemingly burst. After the market closed yesterday, Gill posted an apparent screenshot of his latest gains showing $US8.5 ($11) million more in profits.

Leave a Reply