Does anyone remember March 2021, when some techbros and artists were convinced that NFTs (Non-Fungible Tokens) were going to change the world? Well hi, it’s now June 2021 and the arse has fallen out of that market. I know, I am surprised as you are.

Despite clear evidence that the entire thing was “at best a scam and at worst an impending environmental disaster”, some folks were just too seduced by the promise of something new/making money, and for the briefest time literally hundreds of millions of dollars were sloshing around the world in exchange for videos people didn’t own, or certificates of authenticity for jpgs and gifs.

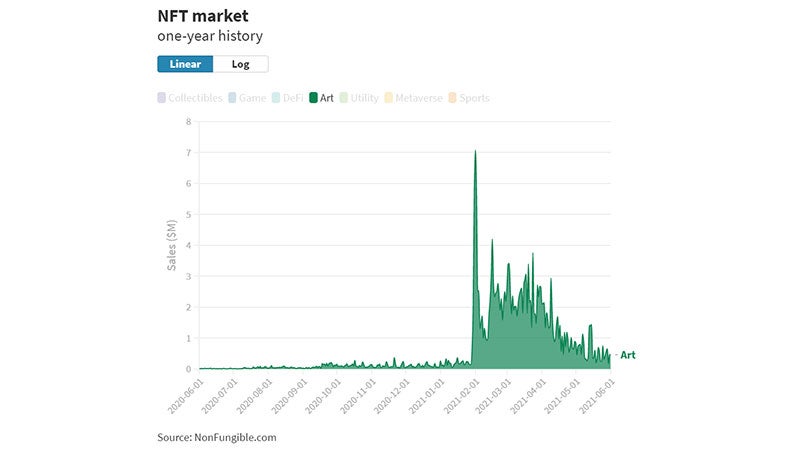

That golden age is now over, though, as we can see in this comprehensive study of recent sales data by Protos. It covers a lot of bases, but the most important figures are:

- The overall NFT market has suffered a “near-90% collapse” since its peak.

- That peak, May 3, saw $US100 ($128) million in “crypto-collectible” sales in just one day. There has been just $US19.4 ($25) million in sales in the past week.

- NFT art sales are even lower, plunging from single days with millions in sales to just $US3 ($4) million in sales globally for the past week, and that’s including both primary and secondary sales.

- The number of active NFT wallets — the accounts being used to purchase the tokens — has fallen from over 12,000 to 3,900.

If you’d like to see that visually, here’s what the crypto art market looks like as of this week:

Now, this isn’t to say any of the companies involved, or the major figures partaking in NFT sales, are going to disappear. There’s a very good chance those most devoted to the idea, those with the greatest belief that this stuff is genuinely the future, will be in this for the long haul. The team behind NBA Top Shots, for example, have already lived through one NFT crash already.

But for now? The bubble has burst, and this hopefully spells the end of breathless and unquestioning mainstream media coverage of the concept, and the deeply questionable gold rush that saw formerly sane artists and fans hurl themselves on the pyre in pursuit of a quick buck.

.

Leave a Reply