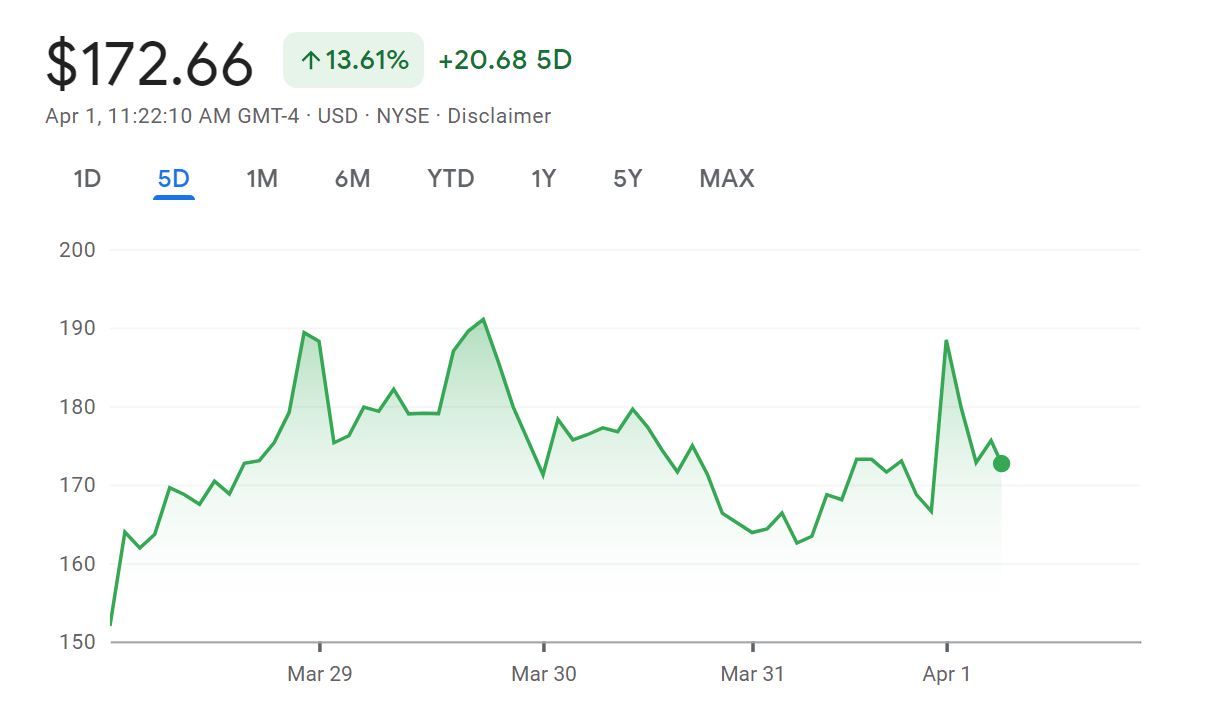

People have been waiting for the GameStop bubble to pop for over a year now. Instead, the ailing brick and mortar video game retailer just posted another record week on Wall Street. Earnings are down. Employee morale is in the pits. But the company’s stock went from $US78 ($108) per share last month to over $US185 ($257) in early trading today, following big moves from its new tech overlord and news of its first stock split in 15 years. Physical games are dying, but zombie GameStop continues on thanks to the market’s endless penchant for Casino-style gambling.

So what exactly is going on? Here’s one explanation for the meme stock’s renewed fury: Last week, GameStop board chairman Ryan Cohen bought 100,000 more shares of the company’s stock. It was a move valued at roughly $US10 ($14) million, and a signal to other investors–and Cohen’s rabid fanbase in the meme stock community–that he has big plans and full confidence in the debilitated retailer.

This week, GameStop also announced an upcoming stock split to increase the total number of shares available from 300 million to 1 billion. That move lowers the price of each individual share while keeping the value the same for all current investors. It’s something companies often do to drive short-term hype, but in GameStop’s case it can also make it easier for random posters on Reddit and elsewhere to get in on the action.

Another explanation for why GameStop’s stock is on fire again is that nobody actually knows what’s going on, and everyone is just trying to catch the latest wave before it all goes bust again. Stock trading is gambling. Historically nobody, however smart they think they are, beats the market. But every lottery has a winner, and lots of people think it could be them.

“GameStop as a company is not doing anything productive,” Kevin Mullally, a finance professor at the University of Central Florida, told NPR yesterday. “But it’s like people buying pet rocks or Beanie Babies. Those things are fundamentally worthless. It’s strange and I don’t understand it. But there are a lot of strange things that people buy and I don’t understand.”

Throughout the GameStop meme stock saga, there’s always been a dispute over how much of it was driven by extremely online trolls versus large and mid-sized professional investors. But no one can deny the frenzy GameStop boosters consistently whip themselves into on trading advice watering holes like WallStreetBets and, more recently, r/GME. “Apparently 16%+ premarket is not good enough to be reported on Bloomberg,” reads the current top post on the GameStop stock community, which remains defined as much by its collective performance of mainstream market resentment as anything else. “Today will be the first day in over a year I won’t be watching the opening bell to fight!” reads another. “I am heading in for surgery. God Bless Gmerica.”

Posters like these might not be legion enough to be responsible for GameStop stock’s massive swings, but the pure id driving their enthusiasm is a much more compelling than the alternative, which is that “it don’t matter, none of this matters.”

The original 2020 case for GameStop was that the company still owns tons of real estate, the PS5 and Xbox Series X/S were about to launch, and the market was undervaluing it at just $US5 ($7) a share. What’s the case for GameStop now? There is none, at least not one that isn’t hitched to the cult of personality around GameStop’s new man behind the curtain, Chewy founder Ryan Cohen. Cohen’s claim to fame was selling pet food online. Over a year later, no one has figured out how that translates to a business where most games are now bought digitally directly through Sony, Microsoft, and Nintendo’s online stores.

Even former Nintendo of America President, Reggie Fils-Aimé, didn’t get it, and ended up ejecting himself from the GameStop meme stock train shortly after it left the station because “there has not been an articulated strategy.” To the extent any strategy exists, it so far seems to revolve around transforming GameStop into a “tech” company and launching a new crypto platform. One good scam begets another.

As always, the people left out of Cohen’s machiavellian market moves and Reddit’s meme stock shiposting are the thousands of people working in the actual stores that deliver actual revenue. “How are we expected to hire ‘the best talent’ yet we pay less than White Castle for assistant managers,” reads the top post today on the GameStop employee “power to the profits” Reddit. The one directly below it simply reads “miserable.”

Despite golden parachutes for executives and unfathomable rallies on Wall Street, store employees routinely tell Kotaku they haven’t received raises in years, despite record inflation and higher rates at big box stores and supermarkets right down the street.

“You want my opinion on the stock?” said one current assistant manager. “All you’re doing when you buy their stock is enable their — and excuse my English — but rather shit treatment on the employees. They see they’re still making money, they’ll still stay the same course.”

Leave a Reply