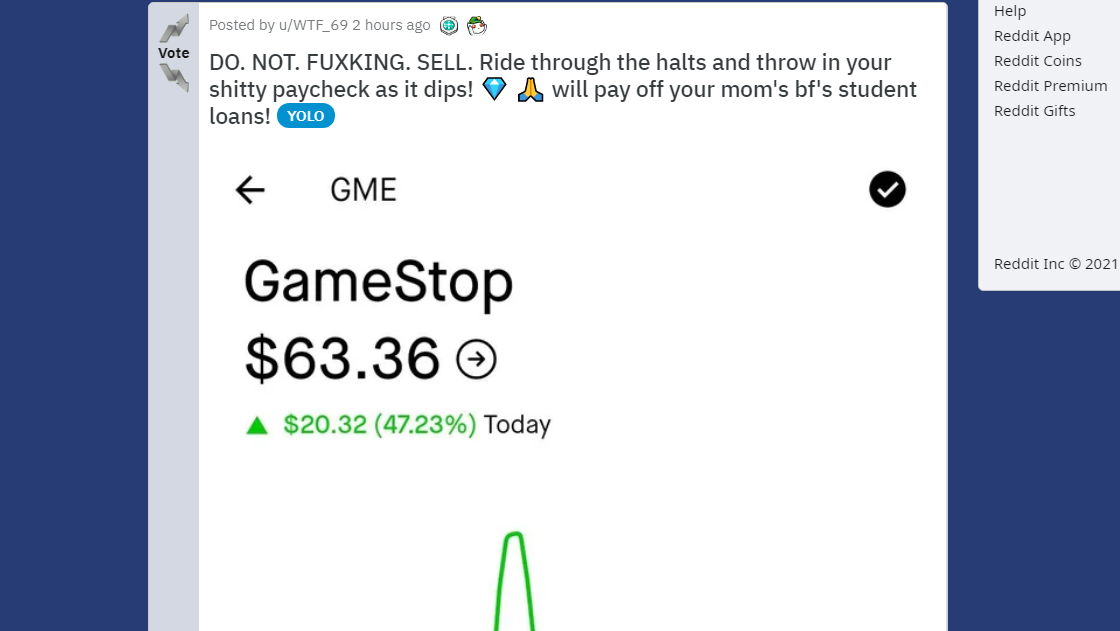

Struggling retailer GameStop’s stock curiously hit an all time high today. But it’s not because Sony, Microsoft, and Nintendo suddenly decided to stop selling their games digitally. And it’s not because a new set of Funko Pops has taken the internet’s imagination by storm.

No, the stock price jumped to an all-time high because some institutional investors bet on the company to fail, and a bunch of amateurs on social media decided to call their bluff and try getting rich in the process.

GameStop has struggled to reinvent itself as video games have increasingly gone digital. Now, established investors and Reddit day-traders are going to war over its future, and making the company’s stock price do ridiculous things in the process.

At the beginning of the year, GameStop’s stock was trading at just under $US20 ($26) a share. In the weeks since, it’s more than tripled in value reaching just over $US73 ($95) at its highest point today. “GameStop is up 174% in January to date, with its average daily rolling 10-day volatility peaking at the highest level in the nearly two decades the stock has been trading,” Bloomberg reported.

GameStop did not immediately respond to a request by Kotaku for comment.

As Ars Technica reported earlier this week, some investors spent last fall shorting GameStop’s stock, effectively speculating that it was overvalued and would implode, possibly making them a bunch of money in the process.

I am not a finance expert. Neither are you, most likely. But the principle of “shorting” is pretty straightforward: you think the price of an asset will go down so you borrow it, sell it at the current price, and then when the price goes down, buy it back to give it to whoever you borrowed it from and pocket the difference.

Meanwhile, people hanging out on subreddits like Wallstreetbets (self-described as “Like 4chan found a Bloomberg Terminal”) and the finance influencer realm of TikTok (nicknamed FinTok) started putting their money behind GameStop’s longevity. The internet-led campaign was made easier by low barrier-to-entry trading apps like Robinhood.

“[E]ssentially, people on WallStreetBets, along with several YouTube and TikTok investors guessed as long as a year ago that if they bought shares of GameStop at a low price, the short sellers would eventually be forced to cover their short en masse, which would drive the price up,” wrote Vice in another great explainer published this week.

Shorting seemed like a sensible bet considering months of bad news and poor financial reports coming out of GameStop. But then, as Vice pointed out, Reddit finance personalities began musing about how they thought GameStop was actually a great investment opportunity. The logic was based on how many other investors were already short selling it. Just today, CNBC reported that GameStop is “the single most shorted name in the U.S. stock market.”

If someone shorts a stock, i.e. sells it and gives the original owner an IOU, and then that original owner needs the stock back, they need to “cover” the short by buying additional stock. This helps pump up the price of the stock even further, making it more valuable and potentially creating a feedback loop where it just goes up and up and up as everyone scrambles to buy back from the same limited pool of shares.

One of the GameStop short sellers is Andrew Left, called “Wall Street’s Bounty Hunter” by The New York Times because of his reputation for shorting companies he considers weak and following up by publishing research about why the company is going to fail, or, in some cases, alleging outright fraud. Yesterday, Left put out a six and a half minute video on YouTube making his case for why GameStop is doomed. WallStreetBets in turn organised what finance pundit Jim Cramer called “an ambush,” pumping up up GameStop’s stock in a coordinated campaign to “squeeze” Left, forcing him to buy tons of stock of his own to “cover” his position and in turn making their shares worth even more. Jim Cramer is an absolute goon, but if anything fits the bill of “Mad Money” it’s this.

Left’s research account, Citron, hasn’t posted on Twitter since yesterday. “Suck it, @CitronResearch,” a GameStop investor relations parody account tweeted today.

GameStop’s current stock situation then likely has less to do with its long-term prospects actually looking up than chaotic amatuer day-traders exacerbating existing weirdnesses in the marketplace. Some of those bullish on GameStop’s fortunes may have rightly sniffed out that short sellers were too negative on the company’s future. As with everything on the internet, what may have started as some people trying to (and succeeding at) making a bunch of quick cash has become much more, including a sort of crusade against Left as well as an unlikely source of GameStop fandom.

Earlier this month, GameStop announced Ryan Cohen would be taking a seat on its board. Cohen is formerly the CEO of the pet food website Chewy.com, but he’s already become a golden boy meme in the world of GameStop stocks. Search his name on Twitter and you’ll find people tweeting things like “Papa Cohen will take us all to mars suit up homies it will be a bumpy ride to the [rocket emoji] so u don’t fall off.”

It’s hard to know how much of this is genuine cult of personality, and how much of it is internet irony, but it speaks to what a bizarre moment GameStop is having right now and the unlikely confluence of events that created it.

Leave a Reply