The video game industry went on a shopping spree in 2021. Epic Games bought Mediatonic (Fall Guys), Sony bought Housemarque (Returnal), and Embracer bought Gearbox (Borderlands). It seemed like things might slow down in 2022, but instead they ramped up even more into an acquisition free-for-all. What will the future bring? Nobody knows. But the biggest companies in gaming are throwing billions around to try to buy their place in it.

So far, Microsoft has been ground zero for the M&A apocalypse. Having already bought Bethesda and half a dozen other studios, it set its sights on the seventh-biggest gaming company in the world: Activision Blizzard. While the opportunistic $US69 billion ($AU103 billion) deal is still at risk of being torpedoed by regulators in Washington and beyond, it’s become the most visible harbinger of industry consolidation speeding up rather than slowing down. Investors proceeded to spend the last 12 months salivating at the prospect of offloading stock in the risky world of game development to the highest bidder, while some smaller studios dreamt of cashing in their chips for the cold embrace of an increasingly tiny handful of megacorporations, though not all.

Behaviour Interactive, responsible for Dead by Daylight and one of the oldest independent studio groups in Canada, told Kotaku it planned to stay that way after it bought Midwinter Entertainment earlier this year. Yacht Club Games, the small indie studio behind Shovel Knight, told Bloomberg it would need 20 gold houses before it would sell out. Larian Studios is another holdout. Currently working on bringing the much-anticipated Baldur’s Gate III out of Early Access, founder Swen Vincke joked to Kotaku that he wouldn’t entertain any offers below $US10 billion ($AU14.9 billion).

Increasingly, however, Larian and others remain the exception rather than the rule. Lots of companies did get bought and sold this year, and it’s far from clear how all of that consolidation will shake out over the long term for industry creativity, developer autonomy, and individual players.

Take-Two absorbs mobile juggernaut Zynga

Mobile gaming was supposed to kill the traditional console gaming business. Instead, it’s becoming part of it. While Zynga used to be synonymous with Farmville, its most popular games these days are things like Poker, Words with Friends, and High Heels! That was enough for Grand Theft Auto publisher Take-Two to spend a whopping $US12.7 billion ($18.9 billion) to acquire it at the beginning of the year. Mobile gaming is worth more than the PC and console gaming markets combined, and big publishers want a piece of it to succeed or at least survive.

Does that mean we’re getting GTA Online ported to smartphones? A Red Dead Redemption riverboat poker sim? Take-Two’s been cagey on exactly how it plans to make two plus two equal five, but Zynga is also a master when it comes to harvesting user data and turning it into ad revenue. The company’s first big post-merger release will be Star Wars: Hunters due out sometime next year, unless it keeps getting delayed.

Sony grabs Destiny 2 maker Bungie

Bungie started out independent, then became part of Microsoft and made Halo, then bought itself out and went private again, entered into a long-term agreement with Activision, and eventually bought itself out of that contract too. In January it found its way to Sony for a cool $US3.6 billion ($AU5.3 billion). The consensus seems to be that the PS5 manufacturer severely overpaid. Maybe that was to keep the Destiny 2 maker out of the hands of Microsoft, or maybe it was because Sony felt Bungie was uniquely situated to help it with its own live service ambitions.

Sony wants to ship close to a dozen games-as-a-service in the next few years, because why risk hundreds of millions on a game you can only sell once when you could get players to pay you every month for expansions, battle passes, and horse armour? In the meantime, Bungie says it will remain its own publisher as it prepares to launch Destiny 2 transmedia projects, a potential mobile game, and a brand new IP. Speaking of mobile, Sony also acquired Savage Game Studios, a new studio founded by industry veterans which is reportedly working on its own big-budget smartphone game, and spun it out into an entire PlayStation Studios Mobile Division.

Embracer hoards Lord of the Rings and eats Square Enix’s leftovers

It never seemed like the publisher of Final Fantasy knew what it wanted to do with Crystal Dynamics and Eidos. It bought them over a decade ago, oversaw the revival of Tomb Raider and Deus Ex, and then continually told investors how disappointed it was in all of those games. 2022 was the year it finally cut and run, unloading them to Swedish holding company Embracer for the bargain bin price of $US300 million ($AU448 million, less than half what it spent to acquire the rights to The Lord of the Rings a couple of months later).

Whether Embracer is interested in the studios themselves or just their famous IPs remains to be seen. It shuttered Square Enix Montreal just months after its big rebrand, and announced its beloved mobile spin-off Deus Ex Go would also be shut down. It was a weird move considering competitors are racing into the deep end of the mobile gaming market, and even sadder for the developers who lost their jobs because of it. And the whole Embracer strategy of 1) buy a bunch of shit, 2) make games, 3) get rich??? is being tested now more than ever. Saints Row was busted and sold below expectations. Dead Island 2 got delayed. And Embracer’s stock price recently fell off a cliff. But at least we might get more Deus Ex.

NetEase throws Quantic Dream a lifeline

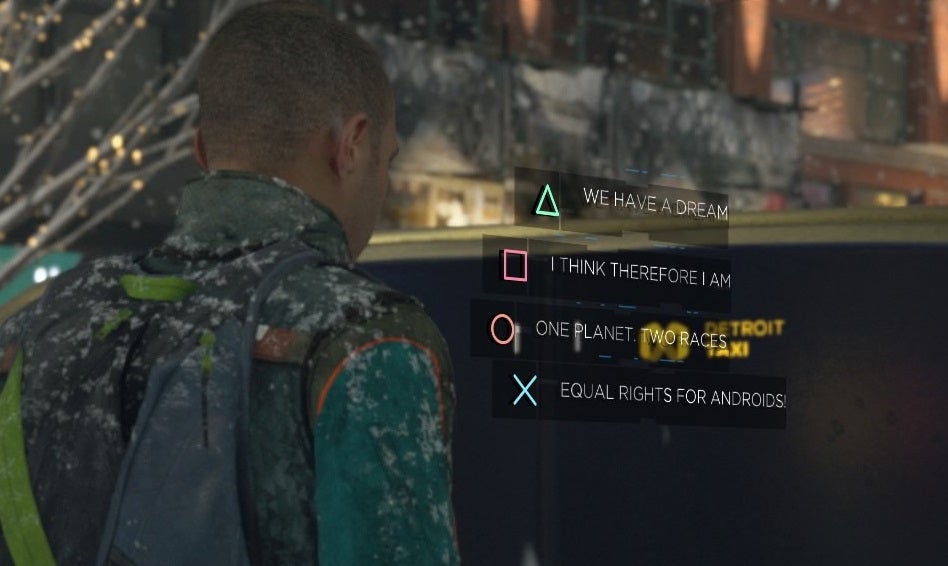

A controversial French game studio at the intersection of lofty rhetoric and cringey interactive narrative experiences, Quantic Dream received a minority investment from tech giant NetEase in 2019. This liberated it from its prior reliance on PlayStation console exclusivity contracts with Sony, and eventually paved the way for the opening of a satellite office in Montreal. Then this year, NetEase bought the studio outright, securing its future amid toxic workplace allegations and increasing development costs.

In addition to publishing upcoming games like Dustborn and Under The Waves, Quantic Dream is also currently working on Star Wars Eclipse. The studio’s first major release since 2018’s Detroit: Become Human is set in the High Republic era of the Star Wars universe, though Kotaku understands that early development on the game had been struggling as recently as last year. But Quantic is far from NetEase’s only bet on gaming. Last year it acquired No More Heroes III studio Grasshopper Manufacture, as well as more recently formed new studios Jackalope Games and Nagoshi Studio helmed by several industry veterans. Just last month, the Chinese firm made a strategic investment in Rebel Wolves, the new studio led by the director of The Witcher 3 that’s currently working on its own upcoming action blockbuster.

Tencent keeps investing in everything

The second-biggest gaming company by revenue, Tencent continued seeding investments and acquisitions in 2022. Over the last year alone, it added Fulqrum Games (King’s Bounty II), Inflexion Games (Nightingale), Novarama (Killsquad), Offworld Industries (Beyond the Wire), Riffraff Games (Bottle), Tequila Works (Rime), and Triternion (Mordhau) to its sprawling list of minority, majority, and 100 per cent ownership stakes (even as it brutally gutted gaming media website Fanbyte).

Tencent also teamed up with rival Sony to buy a collective 30 per cent stake in Elden Ring maker FromSoftware. The deal was worth roughly $US260 million ($AU388 million). Then all by itself, the Chinese conglomerate poured another $US297 million ($AU444 million) into Assassin’s Creed publisher Ubisoft by way of a 49.9 per cent stake in Guillemot Brothers Limited. While being omnipresent in the games industry has made Tencent an easy target, it’s not clear yet how it’s paid off for the company’s own shareholders. This year it suffered the world’s biggest stock wipeout, with prices falling to a five-year low and losing $US62 billion ($AU92.6 billion) — more than the value of Nintendo — since the start of 2022. But at least now it owns Sackboy: A Big Adventure developer, Sumo Digital.

Netflix pockets another indie darling

The streaming giant’s uncertain foray into the world of gaming continued in 2022, even though to this day almost nobody knows you can play a bunch of cool stuff for free through the Netflix app. In March it bought Next Games, maker of the Stranger Things mobile RPG, for $US65 million ($AU97 million). and Boss Fight Entertainment for an undisclosed amount. Then in September it bought Spry Fox Games, makers of the hit Animal Crossing-like for PC, Cosy Grove, for another undisclosed amount.

Adding to a growing roster that began with the acquisition of Night School Studio last year, Netflix also created its own in-house game development team led by former Zynga and EA veterans. While you get to play Poinpy and Into the Breach through the Netflix app, the company has also gestured toward wanting to move into full-blown video game streaming. I’m not sure why it would succeed where Google failed, but the company behind Squid Game and Love Is Blind has basically tapped out its existing subscriber base and is clearly in desperate need of new horizons to conquer, and hell, why not throw a Bridgerton visual novel at the wall and see if it sticks.

Microsoft makes a huge bet on Candy Crush

Ever since the Xbox manufacturer announced its eye-popping all-cash bid to bail out CEO Bobby Kotick’s crumbling Activision empire at a premium price of $US90 ($AU134.55) a share, the question on everyone’s lips was “Call of Duty exclusivity when?” But Microsoft has gone through great pains to argue that the $US69 billion ($AU103 billion) deal is not about console shooters but about mobile gaming. While Call of Duty is a perennial best-seller, Candy Crush and Call of Duty: Mobile both made over a billion all by themselves last year. Microsoft Gaming CEO Phil Spencer even suggested that the deal could provide the company with more leverage to counteract the Apple/Google duopoly on smartphones.

Or maybe that’s just a nice line to try and defang regulators. What seemed like a foregone conclusion at the beginning of the year — that Microsoft would own Activision by June 2023 — continues to come under heavy scrutiny by UK, EU, and US regulators. While agencies on the other side of the Atlantic are preparing for phase two of their investigations, the Federal Trade Commission is currently finishing up its own review. A report by Politico suggested the FTC is likely to file an antitrust lawsuit, while a more recent report by the New York Post suggested regulators will merely try to extract some concessions from Microsoft before approving the deal.

In the meantime, Microsoft has tried to do everything it can to assure anyone who will listen that buying its way to second place in the gaming arms race is actually a good thing that will lead to more choices. The company even managed to rally labour unions to its cause, getting the Communications Workers of America to write a letter to the FTC in favour of the acquisition after it promised not to fight current or future unionization drives. That pledge was put to the test this week when hundreds of quality assurance staff throughout Bethesda announced they were unionizing and Microsoft said it would voluntarily recognise the group. That’s in stark contrast to Activision’s existing management which has fought tooth and nail to prevent developers at its game studios from unionizing.

Leave a Reply